Ask any experienced trader, and you’ll hear that financial markets are the key to building long-term wealth!

But the tricky thing is finding the right trading environment to surround yourself with.

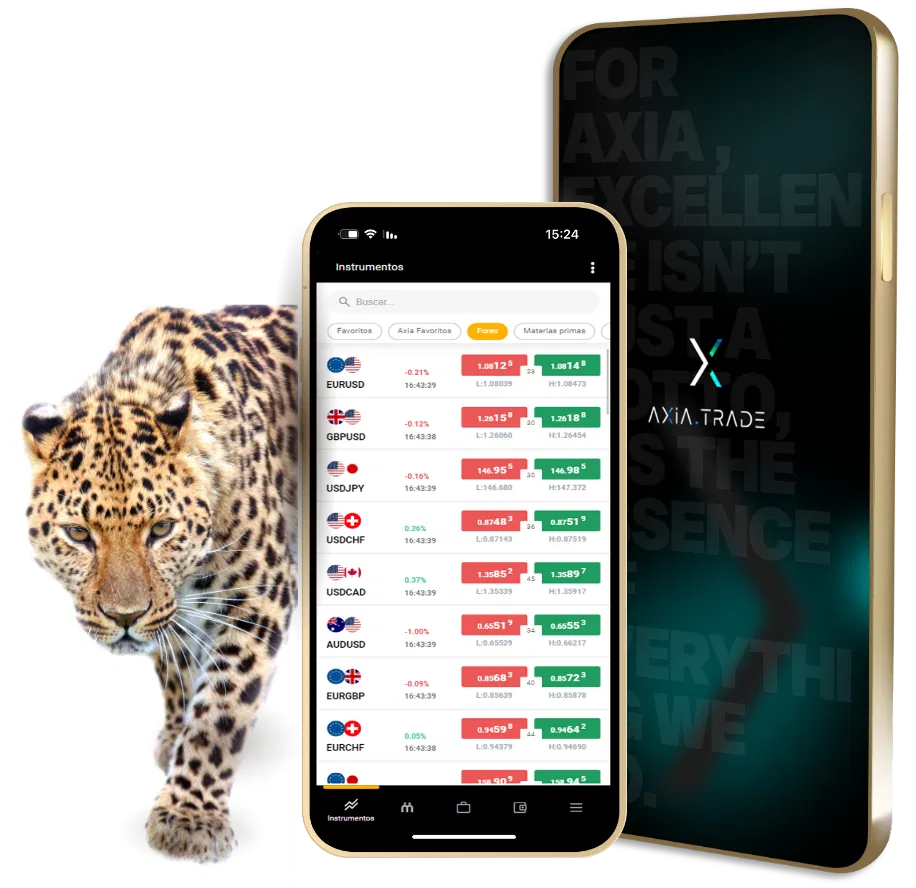

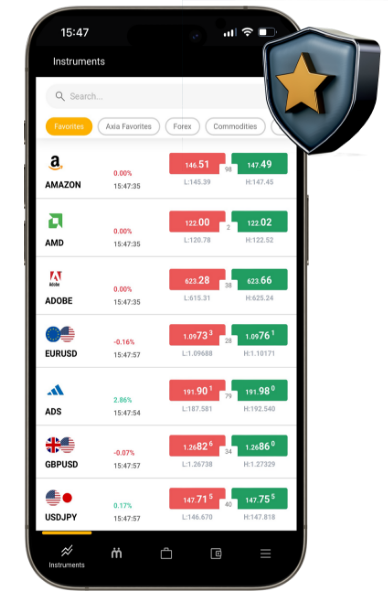

Gain access to over 600 trading instruments from a variety of asset classes such as: Forex, indices, stocks, commodities and many more. Enjoy exceptional trading conditions with low spreads, fast execution, market analysis and a professional team of experts!

With more than $5 trillion traded daily, forex is a leading destination for active traders worldwide. IronFX gives you the opportunity to maximise your potential by trading the most popular currency pairs, such as EUR/USD, USD/JPY and GBP/USD with no requotes and tight spreads starting from 0 pips.

What is stocks trading?

It is the process of buying and selling shares of publicly traded companies on a stock exchange. Once you buy a stock, you practically buy a small ownership stake in the company, and as it grows and becomes more profitable, the value of your ownership stake increases in value and vice versa.

What are the types of stock trading?

There are 2 main types of stock trading: long-term investing and short-term trading. With long-term investing, you buy stocks and hold them for a period of years, whereas short-term trading involves buying and selling stocks over a period of days, weeks, or months in order to make quick profits.

How to trade stocks?

It can be done through a brokerage account, which allows you to place buy and sell orders on the stock exchange. It's extremely important to be aware that stock trading involves risk and potential losses, and it's important to do your research and understand the risks before starting. Trade with a solid investment strategy and diversify your portfolio to reduce risk.

The benefits of trading indices with Axia include access to a wide range of global indices, such as S&P 500, NASDAQ, FTSE 100, and Nikkei 225. This allows traders to diversify their portfolios and take advantage of market trends across different regions and sectors. Axia also offers a range of trading platforms and tools to help traders analyze market data and execute trades more effectively.

What is indices trading?

It is a form of financial trading that involves buying and selling contracts based on the performance of an index, such as NASDAQ and S&P 500. Indices are measures of the performance of a group of stocks and traders speculate on the direction of the index's price movement.

Large Movements

Indices can move 500-2000 points a day on average. This is up to 20 times more than the currency market, and can translate into large trading gains on a successful day.

Also, seeing as 1 point in indices is worth $0.1 and not $10 like currencies, you can apply better risk management overall on these large moves, keeping you less exposed than you would be with other assets.

More Local & Easier to Analyze

Indices track top stocks within a single country. This makes the scope of analysis narrower than truly globalized assets like currencies and commodities, and therefore easier to analyze.

For example, the FTSE 100 is an index that tracks the top 100 companies on the London Stock Exchange. A trader in this case would need to focus on those companies only, without the complex nature of currency-pairing and global asset correlation

Axia provides access to a range of global financial markets, including forex, which allows traders to diversify their trading portfolio and take advantage of opportunities in different economies.

The state-of-the-art trading technology is designed to give traders an edge in the market. This includes advanced charting and analysis tools, real-time market data, and direct market access.

24/5 Trading

Open 5 days a week, around the clock, currency trading is open and accessible for traders around the world, across all major time zones. Every time zone has its own announcements and opportunities for maximum success.

Ultra-liquid

Currencies are the most widely traded assets worldwide, being bought and sold daily at a trading volume of no less than $5 trillion, daily. This high liquidity means tight spreads, immediate execution of trades and less dangerous volatility, compared to other assets.

Easy Access & Fast Execution

To trade currencies, you can simply go long or short on our platform and enjoy immediate execution. Today, with the help of Axia technology, anyone can become a professional trader with access to a wide variety of major currency pairs, minor pairs, exotic pairs and more.

Axia offers competitive pricing for commodity trading, which can help traders to maximize their returns and reduce their costs. Trading commodities with Axia provides you with diversification, a hedge against inflation, access to global markets, advanced trading technology, a supportive trading environment, competitive pricing, and risk management tools and strategies.

Diversifying your Portfolio

With commodities, you can make your overall strategy more effective by diversifying your portfolio and managing risk. The more asset classes you include into your trading strategy as a whole, the more hedging and risk management strategies can be employed. Commodities are classic assets to combine into any trading portfolio.

Correlation-Based Strategies

There are clear statistical correlations between commodities and other assets, and strategies based on these correlations help to boost profits and cushion risk. For example, the relationship between CAD and oil. Being a major oil producer, Canada’s currency tends to rise when oil prices do.

Higher Growth Opportunities

Commodities tend to be more volatile than other asset classes, with large swings and movements alongside geopolitical events. This creates significant opportunities for traders to capitalize on larger moves, yet it should be noted that larger swings also represent an elevated level of risk.

Axia offers Contracts for Difference (CFDs) trading as a way for traders

to gain exposure to a range of financial markets, including forex, commodities, indices, and cryptocurrencies and provides a supportive and collaborative trading environment for traders.

Make Money in Rising or Falling Markets

With CFDs, you can go long or short, in order to trade successfully in any market. In today’s dynamic markets, you can speculate on either direction and capture excellent profits. If you believe an asset will increase in value, you can place a buy order (“go long”). If you believe an asset will decrease in value, you can place a sell order (“go short”). As you can see, profit can be made whatever the market is doing.

A Wide Variety of Trading Opportunities

You can trade forex, shares, indices, commodities, cryptocurrencies and more. The wider your selection of assets to trade, the more trading opportunities you can spot daily. A large variety of opportunities will enable you to select your trades more carefully and enhance your overall success.

Access Global Markets & 24-Hour Trading

You can trade CFDs around the clock, when you want to. The major benefit of this is seamless pricing, and the ability to trade when you see an opportunity, and not only when a market is open. 24-hours means opportunities around the clock, enabling you to carefully select your positions.

Axia offers a wide range of cryptocurrencies to trade, giving traders the ability to diversify their portfolios and take advantage of different market conditions.

Trading with Axia grants traders a user-friendly, secure, and cost-effective way to trade cryptocurrencies and achieve their investment goals.

What is Crypto trading?

It is the buying and selling of cryptocurrencies on an exchange to make a profit from the price movements of the digital assets. Crypto trading involves similar principles to traditional trading, such as buying low and selling high, but with some significant differences.

How to trade Crypto?

Cryptocurrencies are highly volatile and can experience significant price fluctuations within a short period, therefore, traders must react quickly to changing market conditions and be constantly updated with the latest news.

What affects the Crypto market?

The crypto market is highly volatile and the prices are determined by supply and demand, and may be affected by a variety of factors, including market sentiment, news events, regulatory developments, and many more.

Ask any experienced trader, and you’ll hear that financial markets are the key to building long-term wealth!

But the tricky thing is finding the right trading environment to surround yourself with.

Gain access to over 600 trading instruments from a variety of asset classes such as: Forex, indices, stocks, commodities and many more. Enjoy exceptional trading conditions with low spreads, fast execution, market analysis and a professional team of experts!

The benefits of trading stocks with Axia include access to advanced trading technology, low commissions and fees, a wide range of tradable instruments, and educational resources to help traders improve their skills and knowledge. Additionally, Axia offers a high level of customer service and support to help traders navigate the complexities of the financial markets.

The benefits of trading indices with Axia include access to a wide range of global indices, such as S&P 500, NASDAQ, FTSE 100, and Nikkei 225. This allows traders to diversify their portfolios and take advantage of market trends across different regions and sectors. Axia also offers a range of trading platforms and tools to help traders analyze market data and execute trades more effectively.

Axia provides access to a range of global financial markets, including forex, which allows traders to diversify their trading portfolio and take advantage of opportunities in different economies.

The state-of-the-art trading technology is designed to give traders an edge in the market. This includes advanced charting and analysis tools, real-time market data, and direct market access.

Axia offers competitive pricing for commodity trading, which can help traders to maximize their returns and reduce their costs. Trading commodities with Axia provides you with diversification, a hedge against inflation, access to global markets, advanced trading technology, a supportive trading environment, competitive pricing, and risk management tools and strategies.

Axia offers Contracts for Difference (CFDs) trading as a way for traders to gain exposure to a range of financial markets, including forex, commodities, indices, and cryptocurrencies and provides a supportive and collaborative trading environment for traders.

Axia offers a wide range of cryptocurrencies to trade, giving traders the ability to diversify their portfolios and take advantage of different market conditions. Trading with Axia grants traders a user-friendly, secure, and cost-effective way to trade cryptocurrencies and achieve their investment goals.

When markets are extremely volatile and prices are moving rapidly, what you need is a steady broker to keep you on the right path! Gain control over your investments at any time with Axia!

Open your trading account in no time!

When markets are extremely volatile and prices are moving rapidly, what you need is a steady broker to keep you on the right path! Gain control over your investments at any time with Axia!

Award-winner for 3 years straight!

Highest security PSI and SSL

Regulated by the FSA, license number: SD034

Commodities, indices, stocks and more

Secured By SSL. Copyright © Axia Trade. All rights reserved. 2024

Company Information: This website (www.axiainvestments.com/) is operated by Smarttool Trading SC Limited, a Seychelles investment firm, authorised and regulated by the Financial Services Authority of Seychelles with license number SD034. Smarttool Trading SC Limited is located at F20, 1st Floor, Eden Plaza, Eden Island, Republic of Seychelles.

Risk warning: Contracts for difference (‘CFDs’) is a complex financial product, with speculative character, the trading of which involves significant risks of loss of capital. Trading CFDs, which is a marginal product, may result in the loss of your entire balance. Remember that leverage in CFDs can work both to your advantage and disadvantage. CFDs traders do not own, or have any rights to, the underlying assets. Trading CFDs is not appropriate for all investors. Past performance does not constitute a reliable indicator of future results. Future forecasts do not constitute a reliable indicator of future performance. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk tolerance. You should not deposit more than you are prepared to lose. Please ensure you fully understand the risk associated with the product envisaged and seek independent advice, if necessary. Please read our Risk Disclosure document.

Regional Restrictions: Smarttool Trading SC Limited does not offer services within the European Economic Area as well as in certain other jurisdictions such as the USA, British Columbia, Canada and some other regions.

Smarttool Trading SC Limited does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of any financial product. Smarttool Trading SC Limited is not a financial adviser.

Secured By SSL. Copyright © Axia Trade. All rights reserved. 2024

Company Information: This website (www.axiainvestments.com/) is operated by Smarttool Trading SC Limited, a Seychelles investment firm, authorised and regulated by the Financial Services Authority of Seychelles with license number SD034. Smarttool Trading SC Limited is located at F20, 1st Floor, Eden Plaza, Eden Island, Republic of Seychelles.

Risk warning: Contracts for difference (‘CFDs’) is a complex financial product, with speculative character, the trading of which involves significant risks of loss of capital. Trading CFDs, which is a marginal product, may result in the loss of your entire balance. Remember that leverage in CFDs can work both to your advantage and disadvantage. CFDs traders do not own, or have any rights to, the underlying assets. Trading CFDs is not appropriate for all investors. Past performance does not constitute a reliable indicator of future results. Future forecasts do not constitute a reliable indicator of future performance. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk tolerance. You should not deposit more than you are prepared to lose. Please ensure you fully understand the risk associated with the product envisaged and seek independent advice, if necessary. Please read our Risk Disclosure document.

Regional Restrictions: Smarttool Trading SC Limited does not offer services within the European Economic Area as well as in certain other jurisdictions such as the USA, British Columbia, Canada and some other regions.

Smarttool Trading SC Limited does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of any financial product. Smarttool Trading SC Limited is not a financial adviser.

Enjoy the advantages of an award-winning platform and elevate your trades to the next level!