Ask any experienced trader, and you’ll hear that financial markets are the key to building long-term wealth!

But the tricky thing is finding the right trading environment to surround yourself with.

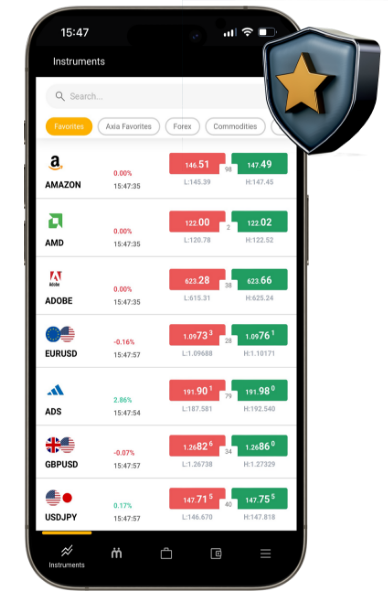

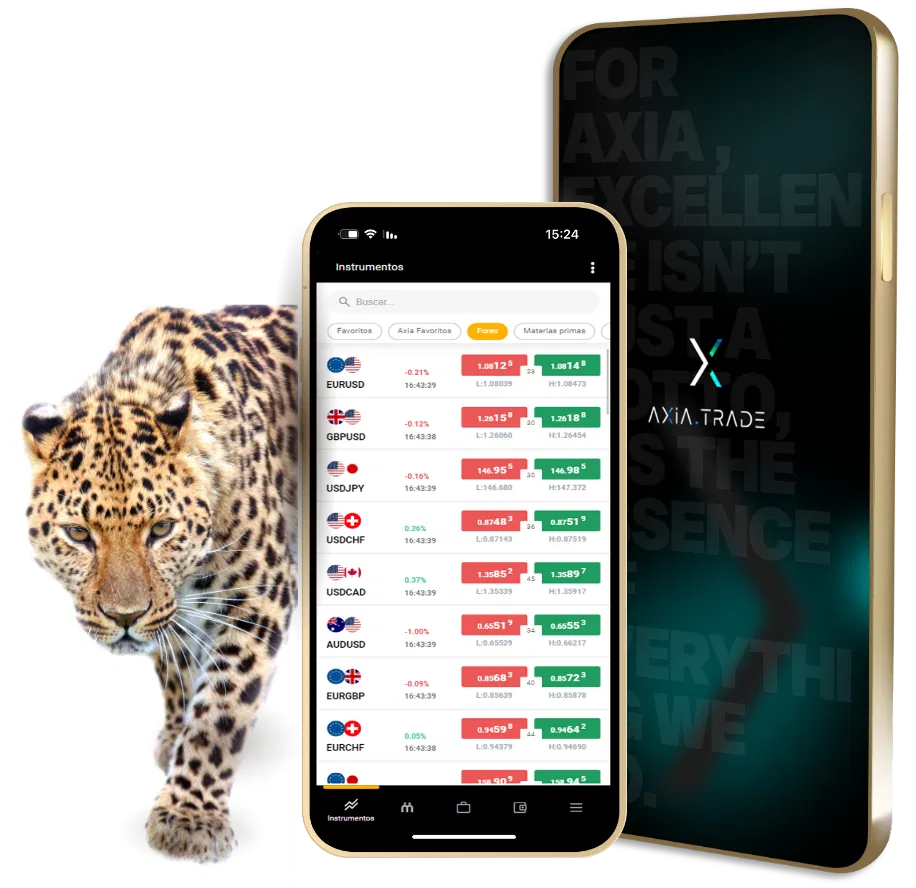

Gain access to over 600 trading instruments from a variety of asset classes such as: Forex, indices, stocks, commodities and many more. Enjoy exceptional trading conditions with low spreads, fast execution, market analysis and a professional team of experts!

With more than $5 trillion traded daily, forex is a leading destination for active traders worldwide. IronFX gives you the opportunity to maximise your potential by trading the most popular currency pairs, such as EUR/USD, USD/JPY and GBP/USD with no requotes and tight spreads starting from 0 pips.

What is stocks trading?

It is the process of buying and selling shares of publicly traded companies on a stock exchange. Once you buy a stock, you practically buy a small ownership stake in the company, and as it grows and becomes more profitable, the value of your ownership stake increases in value and vice versa.

What are the types of stock trading?

There are 2 main types of stock trading: long-term investing and short-term trading. With long-term investing, you buy stocks and hold them for a period of years, whereas short-term trading involves buying and selling stocks over a period of days, weeks, or months in order to make quick profits.

How to trade stocks?

It can be done through a brokerage account, which allows you to place buy and sell orders on the stock exchange. It's extremely important to be aware that stock trading involves risk and potential losses, and it's important to do your research and understand the risks before starting. Trade with a solid investment strategy and diversify your portfolio to reduce risk.

The benefits of trading indices with Axia include access to a wide range of global indices, such as S&P 500, NASDAQ, FTSE 100, and Nikkei 225. This allows traders to diversify their portfolios and take advantage of market trends across different regions and sectors. Axia also offers a range of trading platforms and tools to help traders analyze market data and execute trades more effectively.

What is indices trading?

It is a form of financial trading that involves buying and selling contracts based on the performance of an index, such as NASDAQ and S&P 500. Indices are measures of the performance of a group of stocks and traders speculate on the direction of the index's price movement.

Large Movements

Indices can move 500-2000 points a day on average. This is up to 20 times more than the currency market, and can translate into large trading gains on a successful day.

Also, seeing as 1 point in indices is worth $0.1 and not $10 like currencies, you can apply better risk management overall on these large moves, keeping you less exposed than you would be with other assets.

More Local & Easier to Analyze

Indices track top stocks within a single country. This makes the scope of analysis narrower than truly globalized assets like currencies and commodities, and therefore easier to analyze.

For example, the FTSE 100 is an index that tracks the top 100 companies on the London Stock Exchange. A trader in this case would need to focus on those companies only, without the complex nature of currency-pairing and global asset correlation

Axia provides access to a range of global financial markets, including forex, which allows traders to diversify their trading portfolio and take advantage of opportunities in different economies.

The state-of-the-art trading technology is designed to give traders an edge in the market. This includes advanced charting and analysis tools, real-time market data, and direct market access.

24/5 Trading

Open 5 days a week, around the clock, currency trading is open and accessible for traders around the world, across all major time zones. Every time zone has its own announcements and opportunities for maximum success.

Ultra-liquid

Currencies are the most widely traded assets worldwide, being bought and sold daily at a trading volume of no less than $5 trillion, daily. This high liquidity means tight spreads, immediate execution of trades and less dangerous volatility, compared to other assets.

Easy Access & Fast Execution

To trade currencies, you can simply go long or short on our platform and enjoy immediate execution. Today, with the help of Axia technology, anyone can become a professional trader with access to a wide variety of major currency pairs, minor pairs, exotic pairs and more.

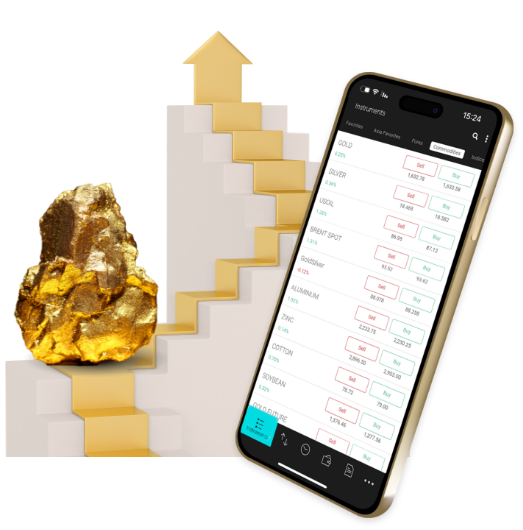

Axia offers competitive pricing for commodity trading, which can help traders to maximize their returns and reduce their costs. Trading commodities with Axia provides you with diversification, a hedge against inflation, access to global markets, advanced trading technology, a supportive trading environment, competitive pricing, and risk management tools and strategies.

Diversifying your Portfolio

With commodities, you can make your overall strategy more effective by diversifying your portfolio and managing risk. The more asset classes you include into your trading strategy as a whole, the more hedging and risk management strategies can be employed. Commodities are classic assets to combine into any trading portfolio.

Correlation-Based Strategies

There are clear statistical correlations between commodities and other assets, and strategies based on these correlations help to boost profits and cushion risk. For example, the relationship between CAD and oil. Being a major oil producer, Canada’s currency tends to rise when oil prices do.

Higher Growth Opportunities

Commodities tend to be more volatile than other asset classes, with large swings and movements alongside geopolitical events. This creates significant opportunities for traders to capitalize on larger moves, yet it should be noted that larger swings also represent an elevated level of risk.

Axia offers Contracts for Difference (CFDs) trading as a way for traders

to gain exposure to a range of financial markets, including forex, commodities, indices, and cryptocurrencies and provides a supportive and collaborative trading environment for traders.

Make Money in Rising or Falling Markets

With CFDs, you can go long or short, in order to trade successfully in any market. In today’s dynamic markets, you can speculate on either direction and capture excellent profits. If you believe an asset will increase in value, you can place a buy order (“go long”). If you believe an asset will decrease in value, you can place a sell order (“go short”). As you can see, profit can be made whatever the market is doing.

A Wide Variety of Trading Opportunities

You can trade forex, shares, indices, commodities, cryptocurrencies and more. The wider your selection of assets to trade, the more trading opportunities you can spot daily. A large variety of opportunities will enable you to select your trades more carefully and enhance your overall success.

Access Global Markets & 24-Hour Trading

You can trade CFDs around the clock, when you want to. The major benefit of this is seamless pricing, and the ability to trade when you see an opportunity, and not only when a market is open. 24-hours means opportunities around the clock, enabling you to carefully select your positions.

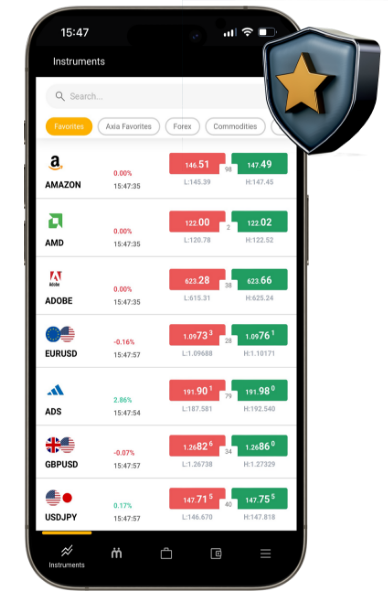

Axia offers a wide range of cryptocurrencies to trade, giving traders the ability to diversify their portfolios and take advantage of different market conditions.

Trading with Axia grants traders a user-friendly, secure, and cost-effective way to trade cryptocurrencies and achieve their investment goals.

What is Crypto trading?

It is the buying and selling of cryptocurrencies on an exchange to make a profit from the price movements of the digital assets. Crypto trading involves similar principles to traditional trading, such as buying low and selling high, but with some significant differences.

How to trade Crypto?

Cryptocurrencies are highly volatile and can experience significant price fluctuations within a short period, therefore, traders must react quickly to changing market conditions and be constantly updated with the latest news.

What affects the Crypto market?

The crypto market is highly volatile and the prices are determined by supply and demand, and may be affected by a variety of factors, including market sentiment, news events, regulatory developments, and many more.

経験豊富なトレーダーに聞けば、金融市場こそが長期的な富を築く鍵だと言うだろう!

しかし厄介なのは、自分を取り巻く適切な取引環境を見つけることだ。

以下のような様々な資産クラスから600以上の取引商品にアクセスできます:FX、株価指数、株式、コモディティ、その他多数。低スプレッド、高速約定、市場分析、専門家チームによる卓越した取引環境をお楽しみください!

Axiaで株式取引を行うメリットには、高度な取引テクノロジー、低コストの手数料、幅広い取引商品、トレーダーのスキルや知識の向上を支援する教育リソースへのアクセスが含まれます。さらに、Axiaはトレーダーが複雑な金融市場をナビゲートできるよう、高レベルのカスタマーサービスとサポートを提供しています。

Axiaでインデックスを取引する利点には、S&P500、NASDAQ、FTSE100、日経225といった幅広いグローバルインデックス( )へのアクセスが含まれます。これにより、トレーダーはポートフォリオを多様化し、さまざまな地域やセクターの市場動向を活用することができます。Axiaはまた、トレーダーが市場データを分析し、より効率的に取引を実行できるよう、さまざまな取引プラットフォームやツールを提供しています。

Axiaは、外国為替を含むさまざまなグローバル金融市場へのアクセスを提供し、トレーダーは取引ポートフォリオを多様化し、さまざまな経済圏の機会を活用することができます。

最先端の取引テクノロジーは、トレーダーがマーケットで優位に立てるように設計されています。これには、高度なチャートと分析ツール、リアルタイムのマーケットデータ、マーケットへの直接アクセスが含まれます。

アクシアは商品取引に競争力のある価格設定を提供し、トレーダーのリターンの最大化とコスト削減に貢献します。アクシアのコモディティ取引は、分散投資、インフレヘッジ、グローバル市場へのアクセス、高度な取引テクノロジー、サポート体制の整った取引環境、競争力のある価格設定、リスク管理ツールや戦略を提供します。

Axiaは、トレーダー( )がFX、コモディティ、インデックス、暗号通貨を含むさまざまな金融市場にアクセスするための方法として、差金決済取引(CFD)を提供しており、トレーダーをサポートする 、協力的な取引環境を提供しています。

Axiaは幅広い暗号通貨の取引を提供しており、トレーダーはポートフォリオを多様化し、さまざまな市場環境を利用することができます。Axiaでの取引は、トレーダーが暗号通貨を取引し、投資目標を達成するためのユーザーフレンドリーで安全かつ費用対効果の高い方法を提供します。

市場が非常に不安定で値動きが激しいとき、必要なのは正しい道を歩むための安定したブローカーです!アクシアでいつでも投資をコントロールしましょう!

Open your trading account in no time!

市場が非常に不安定で値動きが激しいとき、必要なのは正しい道を歩むための安定したブローカーです!アクシアでいつでも投資をコントロールしましょう!

3年連続で受賞!

最高レベルのセキュリティ PSIおよびSSL対応

FSAによって規制されており、ライセンス番号はSD034です。

コモディティ、株価指数、株式など多彩な資産

SSLで保護されています。著作権 © Axia Trade.無断複写・転載を禁じます。 2024

会社情報このウェブサイト(www.axiainvestments.com/)はSmarttool Trading SC Limitedによって運営されています。Smarttool Trading SC Limitedはセーシェルの投資会社であり、ライセンス番号SD034でセーシェル金融サービス機構によって認可および規制されています。Smarttool Trading SC Limitedの所在地はF20, 1st Floor, Eden Plaza, Eden Island, Republic of Seychellesです。

リスクに関する警告差金決済取引(CFD)は、投機的な性格を持つ複雑な金融商品であり、その取引には資本損失の重大なリスクが伴います。差金決済商品であるCFDの取引は、お客様の全残高を失う可能性があります。CFDにおけるレバレッジは、有利にも不利にも働く可能性があることを覚えておいてください。CFDトレーダーは原資産を所有しておらず、原資産に対するいかなる権利も有していません。CFD取引はすべての投資家に適しているわけではありません。過去の実績は将来の結果を示す信頼できる指標ではありません。将来の予測は、将来のパフォーマンスの信頼できる指標を構成するものではありません。取引を決定する前に、投資目的、経験レベル、リスク許容度を慎重に検討する必要があります。損失覚悟額以上の金額を入金すべきではありません。想定される商品に関連するリスクを十分に理解し、必要に応じて独立した助言を求めるようにしてください。当社のリスク開示文書をお読みください。

地域制限Smarttool Trading SC Limitedは、欧州経済地域内、および米国、ブリティッシュコロンビア州、カナダ、その他の一部の地域などの特定の法域ではサービスを提供していません。

Smarttool Trading SC Limitedは、いかなる金融商品の取得、保有または処分に関する助言、推奨または意見を発行しません。Smarttool Trading SC Limitedは財務アドバイザーではありません。

SSLで保護されている本ウェブサイト(www.axiainvestments.com/)は、セーシェル金融サービス庁(FSA)に認可・規制され、

ライセンス番号SD034を持つSmarttool Trading SC Limited(所在地:F20, 1st Floor, Eden Plaza, Eden Island,

Republic of Seychelles)によって運営されています。同社はRedpine Capital Limited(会社番号393695、所在地:キプロス

共和国リマソール市Vasili Michaelidi 21-23, Areti Tower, 2nd Floor, 3026)と同グループに属しています。差金決済取引

(CFD)は複雑かつ投機的な金融商品であり、資本の大幅な損失リスクを伴います。レバレッジは利益を増大させる一方で損失を拡大さ

せる可能性もあり、CFD取引者は原資産を保有せず、全ての投資家に適しているわけではありません。過去の成績は将来の成果を保証せ

ず、取引前には投資目的、経験、リスク許容度を慎重に検討し、失っても問題ない範囲内での入金をお勧めします。当社は欧州経済領域

(EEA)、

米国、カナダ・ブリティッシュコロンビア州など一部地域でサービスを提供しておらず、金融商品の取得・保有・処分に関する

アドバイスや推奨は一切行っておらず、金融アドバイザーではありません。メールマーケティング資料の受信に同意したものとみなされま

すが、配信停止はいつでも可能です。Copyright © Axia Trade. All rights reserved. 2024.

Enjoy the advantages of an award-winning platform and elevate your trades to the next level!