Inicie su viaje comercial con promociones inmejorables!

Ofrecemos un atractivo bono de bienvenida que aumenta su potencial comercial desde el principio!

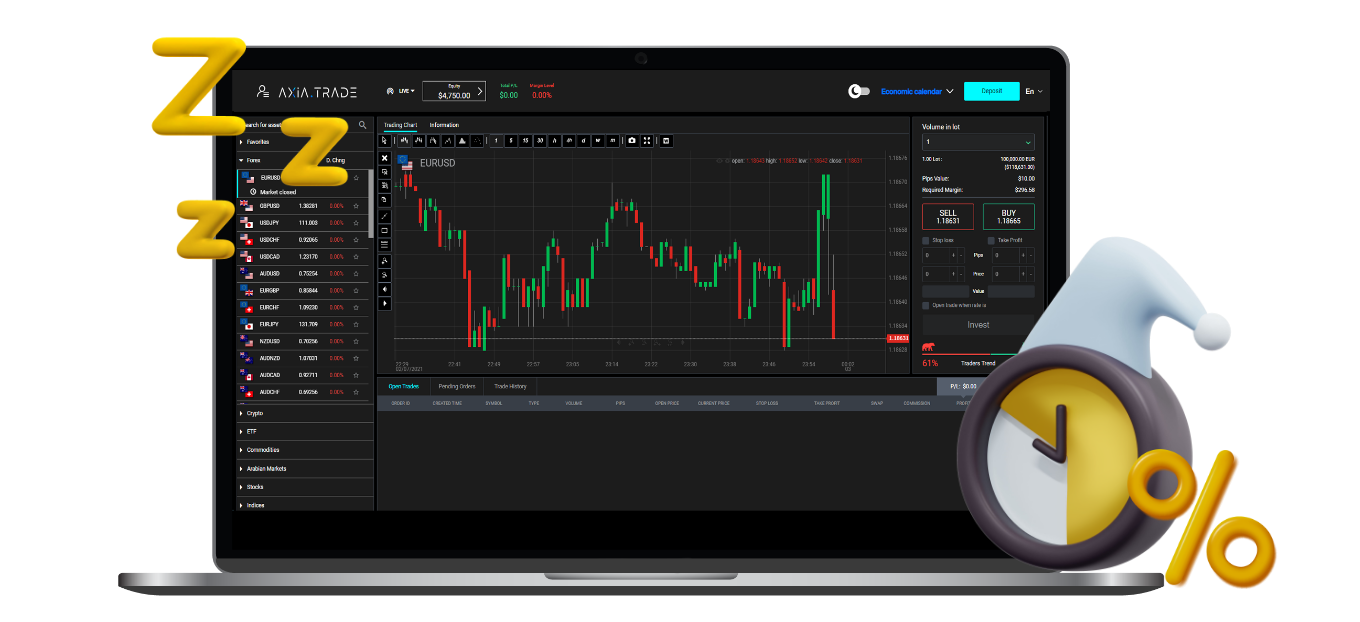

Ingrese a los mercados con las mejores condiciones comerciales!

Pregúntele a cualquier operador experimentado y escuchará que los mercados financieros son la clave para generar riqueza a largo plazo.

Pero lo complicado es encontrar el entorno comercial adecuado del que rodearse.

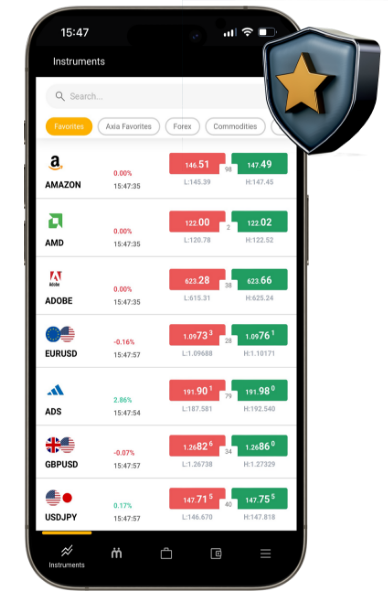

Obtenga acceso a más de 600 instrumentos comerciales de una variedad de clases de activos como: Forex, índices, acciones, materias primas y muchos más. Disfrute de condiciones comerciales excepcionales con diferenciales bajos, ejecución rápida, análisis de mercado y un equipo profesional de expertos!